HOW TO PROVE YOU ARE OWED WAGES

Our lawyers have handled many cases In which we have had to prove the existence of AN employee’s unpaid wages. The fact you do not presently have your paystubs or time sheets may not matter. Once a lawsuit is filed for unpaid wages we are entitled to obtain copies of your time sheets and paystubs. Given our extensive experience representing employees in unpaid wage lawsuits, we can truthfully tell you we have been confronted with having to prove unpaid wages when there are not any time sheets at all. We have also had cases where the time sheets are inaccurate, or many are missing.

CALL 877-525-0700 to speak to an experienced lawyer who knows how to prove unpaid wages

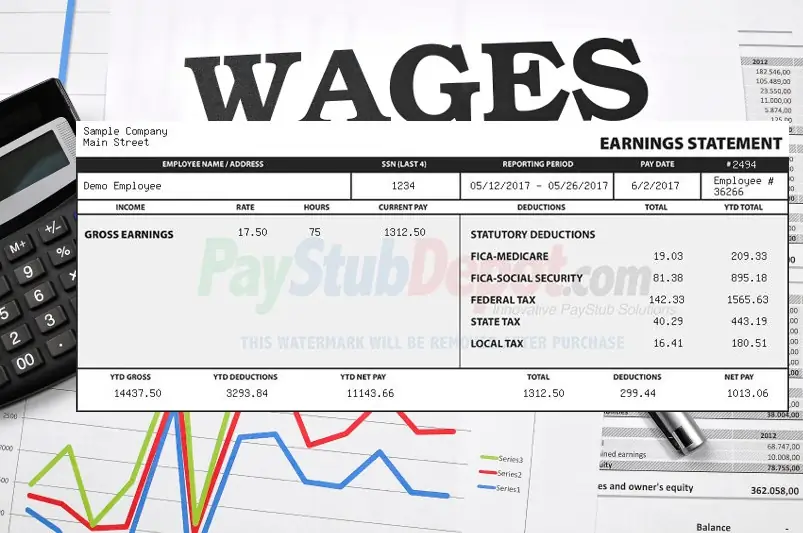

In our initial client contact we will begin formulating strategies how to prove that you are owed wages. If you have some of your paystubs that is great. To an experienced wage and hour lawyer, looking at a paystub is like a doctor reading an x-ray, or MRI. Paystubs tell an experienced labor attorney many things. Paystubs may be missing statutorily required information. Labor Code violations entitling the employee to penalties exist for every bad paystub.

In cases involving off-the-clock work there may be records showing what the employee did when they were off-the-clock. Restaurants have point of sale records. Medical professionals may have logged information into the computer. Oil field workers often have reports showing the dates and times certain things were done. DOT records should show when driving occurred. We will figure out what records exist to prove you were working when clocked out for meal breaks, or simply clocked out.

EMPLOYER NOT PAYING

After performing mentally or physically difficult work the worst thing is not to be paid. Our mission is to assist employees in obtaining compensation when their employer failed to properly pay them. Some cases involve no pay. Other cases involve inadequate pay. Tell us your story and we can determine what it is you might be owed.

Unpaid wages take many forms. Everybody knows minimum wage and overtime has to be paid. Not everybody knows that piece rate and fixed rate bonuses have to be included in overtime rates. Technically, commissions and bonuses are also considered wages. Stock options can also be considered an unpaid wage.

Failing to pay wages leads to many penalties. The penalties associated with unpaid wages often exceed the amount due in unpaid wages. Unpaid wage lawsuits ask for the unpaid wages, interest, penalties, attorney fees, and costs.

CAN YOU SUE A JOB FOR NOT PAYING YOU?

Anybody can sue for unpaid wages. Not everybody can prove their case. Not every wage lawyer knows how to prove unpaid wages. Not every wage attorney knows how to actually arbitrate or try in court a wage and hour case. The first 70 days of 2022 our top wage lawyer tried two wage and hour cases.

Besides trying wage and hour cases, it is important to be able to defeat the defenses the employer raises. In a year’s period of time our law firm has opposed motions employers filed to throw out at least 20 different wage and hour actions. These cases have involved overtime, minimum wage, controlled standby pay, meal break violations, rest break violations, off-the-clock work, many Labor Code violations, and penalties. We know wage and hour law. We understand all of it; the Wage Orders, how C.F.R.A.s are different, and the defiance between California wage law and Federal Wage Law.

Give our law firm a chance. Call 877-525-0700 for experienced wage lawyers who are not just about trying to get the fastest settlement possible on your case.

Some of our results during the pandemic include:

$775,000 for unpaid meal and rest breaks in a small class action

$350,000 for an employee whose overtime did not include flat rate bonuses

$275,000 for two IT workers on-call

$305,000 for two hospital workers on-call

$250,000 for off-the-clock work and PAGA allegations in the vacation rental business